Israeli Arab terrorists owe millions in taxes for salaries received from Palestinian Authority

- The PA pays monthly salaries to terrorists imprisoned in Israel’s prisons

- Terrorists who are Israeli citizens or residents of Jerusalem receive a special bonus

- The Israeli Arab terrorists have never paid income tax on these monthly salaries

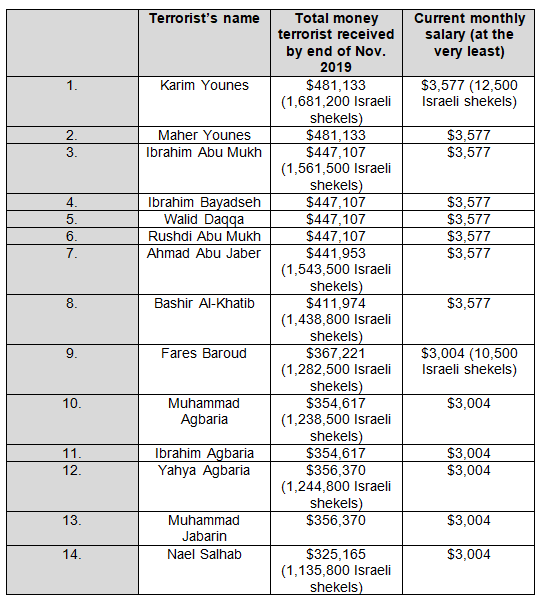

- PMW calculated salaries of 8 terrorist murderers who currently receive net monthly salaries of (at least) $3,577 (12,500 Israeli shekels), and another 6 terrorist murderers who receive net monthly salaries of (at least) $3,004 (10,500 Israeli shekels). These terrorists alone have received a total of approximately $5.72 million (20 million Israeli shekels) from the PA as a reward for the murder of Israelis, and have not paid taxes.

- In total the terrorists who are Israeli citizens owe millions of dollars in back taxes to the Israeli government

Detained or imprisoned terrorists who are Israeli citizens or residents of East Jerusalem enjoy monthly salaries from the Palestinian Authority from the day of their arrest, on condition that they were arrested for terror activity. The terrorists have never reported this income, nor paid the taxes they owed for this income. What is more, the terrorists continued to receive the salaries even when the PA paid them through an organization that was declared by the Israeli Minister of Defense as a terror organization, without the appropriate actions being taken to prevent the salary payments and/or any other action in response to money being received from a terror organization. The cumulative result is that the terrorists, including murderers, have both received payments from a terror organization and not paid large sums in taxes on the income received from the PA, which Palestinian Media Watch estimates to be worth millions of Israeli shekels each year.

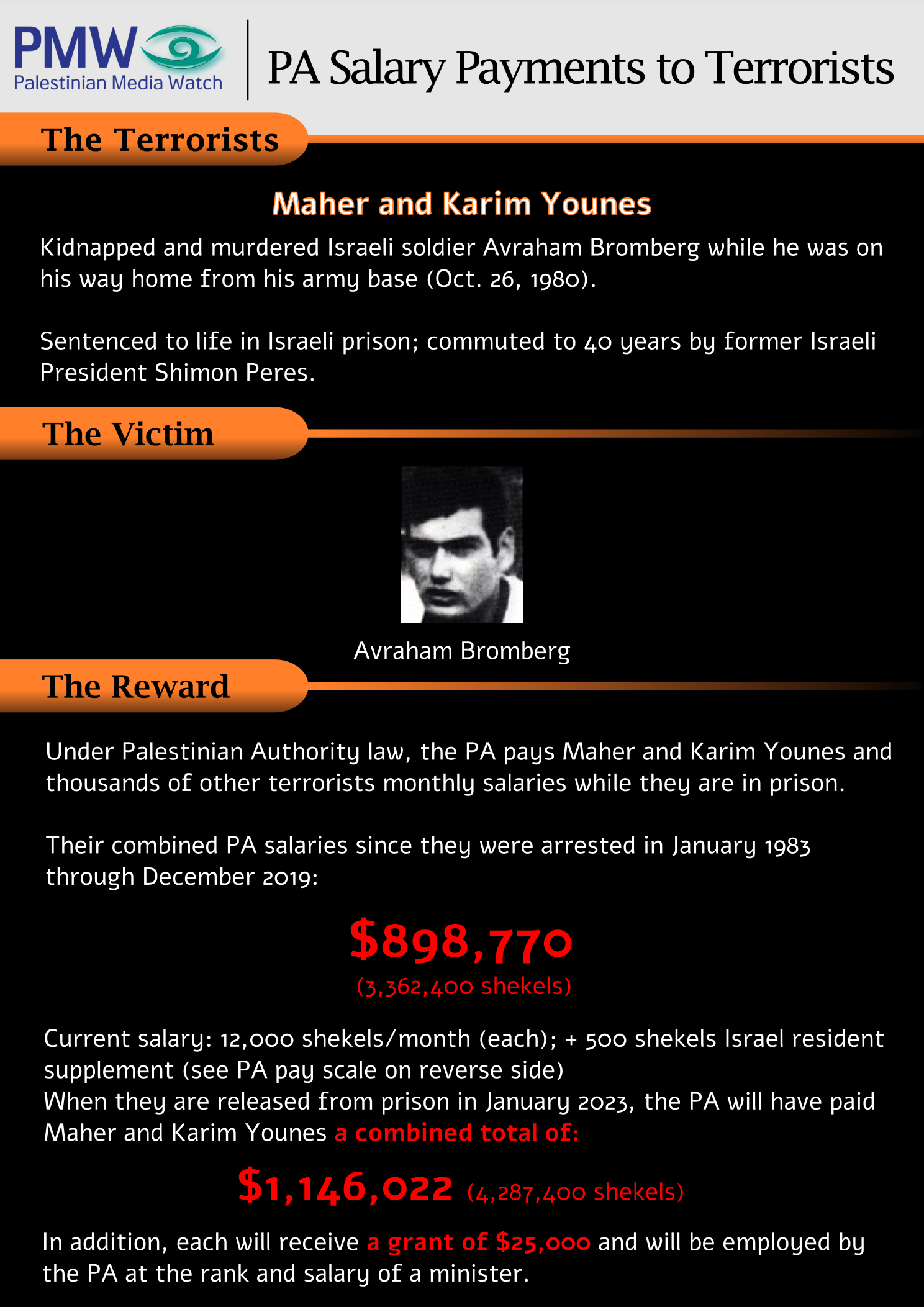

Among the terrorists who have concealed the largest incomes are the murderers of Israeli soldier Avraham Bromberg – Maher Younes and Karim Younes – who during their imprisonment have each received salaries totaling more than $481,133 (1,681,200 Israeli shekels); as well as the four murderers of Israeli soldier Moshe Tamam – Walid Daqqa, Ibrahim Bayadseh, Ibrahim Abu Mukh, and Rushdi Abu Mukh – who during their imprisonment have each received salaries totaling more than $447,107 (1,561,500 Israeli shekels).

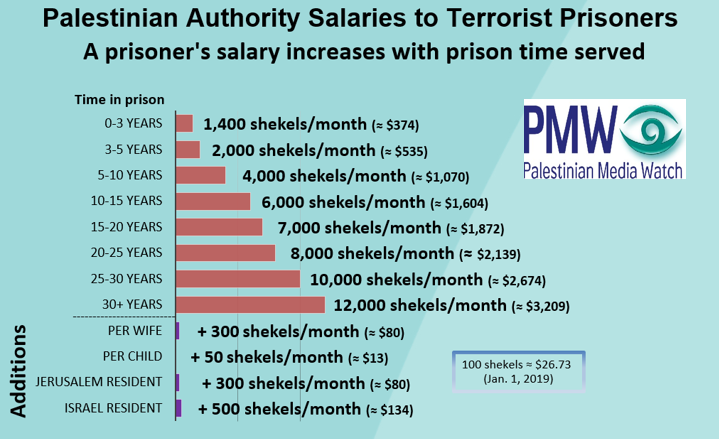

Since its establishment, the PA has been paying monthly salaries to the terrorists imprisoned in Israeli prisons. The salaries are paid to the terrorists after being imprisoned for their participation in terror activity. According to the PA’s pay scale, the salary of an imprisoned terrorist begins at $401 (1,400 Israeli shekels) from his first day of imprisonment, and gradually rises to $3,435 (12,000 Israeli shekels) a month, in accordance with the amount of time he has been in prison. Terrorist prisoners who are married, have children, or are Israeli citizens or residents of East Jerusalem receive a special addition to the base salary. In 2018, the PA paid no less than $143.7 million (502 million Israeli shekels) to imprisoned terrorists and released terrorists.

The issue of classifying the salaries that the PA pays to the imprisoned terrorists as “income” came up in the framework of a position paper the Israeli Attorney General (AG) recently submitted to the National Labor Court. In that matter, the AG dealt with the question of whether the payments from the PA to the terrorists should be considered as “income” when the Israeli National Insurance Institute examines the request of an imprisoned terrorist’s father to receive a social welfare benefit referred to as “guaranteed minimal income”.

In a systematic and detailed position, the AG surveyed the circumstances of these payments, and determined that they should be considered as "income." The definition of "income" in the Guaranteed Minimal Income law is actually taken from the Income Tax law. Hence just as these payments should be viewed as “income” according to the Guaranteed Minimal Income law, they should certainly be viewed as “income” according to the Income Tax law.

In other words, according to the AG’s position, those receiving the salaries owe income tax payments for the salaries that were paid to them. Given this position, there is no reason in the world for the Israeli law enforcement agencies not to act to collect the full taxes that were not paid by the terrorists for their income.

What is more, in the framework of the position submitted by the AG, he rightly noted that at a certain point the PA started paying terrorists’ salaries through the Palestine National Fund (PNF), the PLO’s financial arm. In short, for years the PA paid the terrorists’ salaries directly from the accounts of the PA. In 2014, as a result of international criticism, the PA decided not to pay the salaries directly from the PA’s accounts, but rather to first transfer the money to the PNF and pay the salaries to the terrorists from there.

Due to the PNF’s involvement in these payments, and after it was understood that the PA was paying the salaries as a reward for committing terror activity, then Israeli Defense Minister Avigdor Liberman declared the PNF a terror organization in March 2017. Given this, by the very act of receiving the salaries from the PNF the terrorists committed new crimes which on the one hand justifies putting them on trial, and on the other hand justifies a seizure and confiscation of all the money whose source is the PNF.

Moreover, relying on the instructions of the Israeli Anti-Terror law, the AG added that even when the salaries are paid directly by the PA, it is forbidden to receive the payments themselves, and in certain circumstances the person receiving them transgresses the anti-terror law.

The inherent conclusions of the position submitted by the AG are, at the very least, as follows:

- The salaries that the PA paid and is paying to the imprisoned terrorists who are Israeli citizens or residents of East Jerusalem must be viewed as “income” according to the Income Tax law. Accordingly it is necessary to immediately send the relevant terrorists a demand to pay the back taxes they owe.

- The taxes that were not paid by the terrorists must be collected with the addition of linkage to inflation, interest, and interest for delay, just as the tax authorities treat citizens who are not terrorists.

- The terrorists must be put on trial for committing new crimes.

- The money has been paid and is paid to the terrorists must be seized relying on the rules regarding tax evasion and anti-terror financing laws. These rules, such as the rule determined in the case of terrorist Talal Shreim (HCJ 3233/07 – Talal Shreim v. Commander of IDF Forces in the West Bank) enable the seizure of money worth the value of the terror money with which the crime was committed, even if it is not the same exact money.

In order to convey the most important deterrent message in this context, PMW suggests starting the law enforcement activities against 14 veteran terrorist prisoners who are all Israeli citizens, and who until now have received from the PA a total of $5.72 million (approximately 20 million Israeli shekels) without paying taxes, as detailed in the following table:

When calculating the taxes owed by the imprisoned terrorists, it is necessary to take into account that the salaries were paid as a net sum.

Beyond the aforementioned terrorists, PMW also suggests initiating similar procedures against two other terrorists – Muhammad Jabarin and Samir Sarsawi – who were recently released after serving long prison sentences, and received salaries totaling $407,506 (1,423,800 Israeli shekels) and $402,554 (1,406,500 Israeli shekels) respectively. Each of these terrorists also received a special “release grant” of $15,000, and apparently they continue to receive salaries from the PA even as released terrorists.

In conclusion, it appears that the Israeli authorities are beginning to understand and internalize the significance of the payments that the PA is making to the imprisoned terrorists, although at the current stage this is only regarding terrorists who are Israeli citizens or residents of East Jerusalem. This understanding must be translated into concrete actions that will not only prevent them from receiving additional social welfare payments from Israel, but also into initiatives to enforce the law against the terrorists based both on the tax laws and based on the anti-terror law. Only determined and uncompromising enforcement can contribute to making the murderers realize that terrorist activities don’t pay.